Company car tax rates for 202122. New and unused car CO2 emissions are 50gkm or less or car is electric - First Year Allowance 100 New and unused car CO2 emissions are between 50gkm and 110 gkm - Main Rate Allowance 18 Second hand car CO2 emissions are 110 gkm or less or car is electric - Main Rate Allowance.

Wenn Audi Mit Seinen Elektrofahrzeug An Tesla Heran Will Vorsprung Durch Technik Ist Offensichtlich P Electric Cars Incentive This Or That Questions

Wenn Audi Mit Seinen Elektrofahrzeug An Tesla Heran Will Vorsprung Durch Technik Ist Offensichtlich P Electric Cars Incentive This Or That Questions

Updated for tax year 2021-2022.

Tesla company car capital allowances. 100 Capital Allowances on Cars. Just select your Tesla from the list to calculate. Providing no other claims have been made including the Capital Allowance you can receive simplified mileage expenses on business vehicles as long as youre a sole trader or a partner.

Calculate the company car tax and any fuel benefit charge on your actual income. Below is a list of currently available makes. 5000 SEAI plug-in grant for personal purchase.

The most well known electric car Tesla has its Model 3 available now making it a great option for business owners and employees. When you sell the vehicle the proceeds may result in the whole amount being added to your profit and taxed at 19 for corporates a good excuse to then go and. The main areas of risk for capital allowances for plant and machinery broadly fall into the following categories.

This is in addition to the normal Annual Investment Allowance. However it drops all the way down to 2 in 20202021. Electric car capital allowances.

Amazingly the tax man continues to allow businesses to claim 100 allowances if they buy the vehicles. It is 16 in 20192020. This means you can deduct part of the value of the car from your profits before tax.

Its possible to claim capital allowances on cars which are bought for business use. The rate isnt great at the moment. Updated for tax year 2021-2022.

Unfortunately cars do not qualify for the Annual Investment Allowance but you can use the Writing Down Allowance to work out what you are eligible to claim for. You can also optionally add your capital contribution. This means you can deduct part of the value from your profits before you pay tax.

There are a couple of benefits for having the company buy the car and the assign it to you as a company car. This Enhanced Capital Allowance. Enhanced capital allowances ECA energy-saving and environmentally beneficial plant and machinery Withdrawn except in respect of Enterprise Zones.

This means a nice reduction in your corporation tax The downside is that when you sell the car then whatever you sell it for is considered profit and corporation tax is liable on profit. Electric car charging points. By choosing a Tesla car your business can claim a 100 year one deduction for the cost of the vehicle.

Lack of such records can mean that information provided is. If the cash basis has been adopted then capital allowances are not available except for cars. You would pay tax on 13 of the value of the Tesla for year 20182019.

100 from 23 November 2016. 0 benefit-in-kind tax rate only available to zero emission vehicles 0 rate applies to the value of the car below 50000 effective until 31 Dec 2022 Every new Model 3 Model S and Model X is compatible with. A first-year allowance which allows the company to deduct the full cost from profits before tax.

If an employee enters into a company car arrangement after 5th April 2017 where the cars CO 2 emissions are over 75gkm and some form of remuneration is foregone enter the annual amount of the salary sacrifice or the car allowance. List of all Tesla models. Instantly compare with taking a cash allowance instead.

Capital Allowances and 100 deductions under the Annual Investment Allowance AIA have been with us for some time now and whilst you can claim AIA on most items of plant and machinery AIA isnt available on cars. You can claim capital allowances on cars you buy and use in your business. Calculate the company car tax and any fuel benefit charge on your actual income.

The cars CO2 emissions as well as the date it was purchased will determine the availability of the Capital Allowance as well as the relevant rate. Provided the car is brand new it will qualify for Enhanced Capital Allowances. Tesla Model 3 Tesla Model S Tesla Model S New Tesla Model X Tesla Model X New.

As with car tax and company car tax the rate at which a company can write down the value of company vehicles is based on its CO2 emissions. Lowest VRT tax band 7 Low annual road tax of 120. Record keeping Good record keeping is essential.

100 First Year Allowance FYA First Year Allowance is claimable for up to 100 of the cost of qualifying low emission and electric cars. It swings about though as from 31 March 2021 you wont be able to claim the 100 First Year Allowance. Just select your Tesla Model 3 from the list to calculate.

The AIA cap is 1m for purchases made in 2019 and 2020 and will revert to 200000 on 1 January 2021. Use writing down allowances. The full list price of the car can be written off against profit in year one.

However within the Capital Allowances regime are First Year Allowances FYA and where an asset qualifies for FYA you can deduct the full cost against profits by claiming 100 allowance. This is an additional tax you pay on behalf of the employee for benefits from the company. The driver will be taxed on whichever is the higher amount of the car benefit or the sacrificed remuneration.

Capital allowances allow businesses to deduct the cost of an eligible expense from its annual tax bill. Assuming the car is for personal use you will need to pay benefit in kind. So a company buying a 80000 Tesla will have its profit reduced by 80000 saving 15200 in tax.

You can also optionally add your capital contribution. Instantly compare with taking a cash allowance instead. Battery electric and plug-in hybrid vehicles with CO2 emissions below 50 gkm are currently eligible for 100 write-down in the first year.

Beware theres a sting in the tail.

How To Buy Or Lease A Car In Germany Autokauf In Deutschland The German Way More

How To Buy Or Lease A Car In Germany Autokauf In Deutschland The German Way More

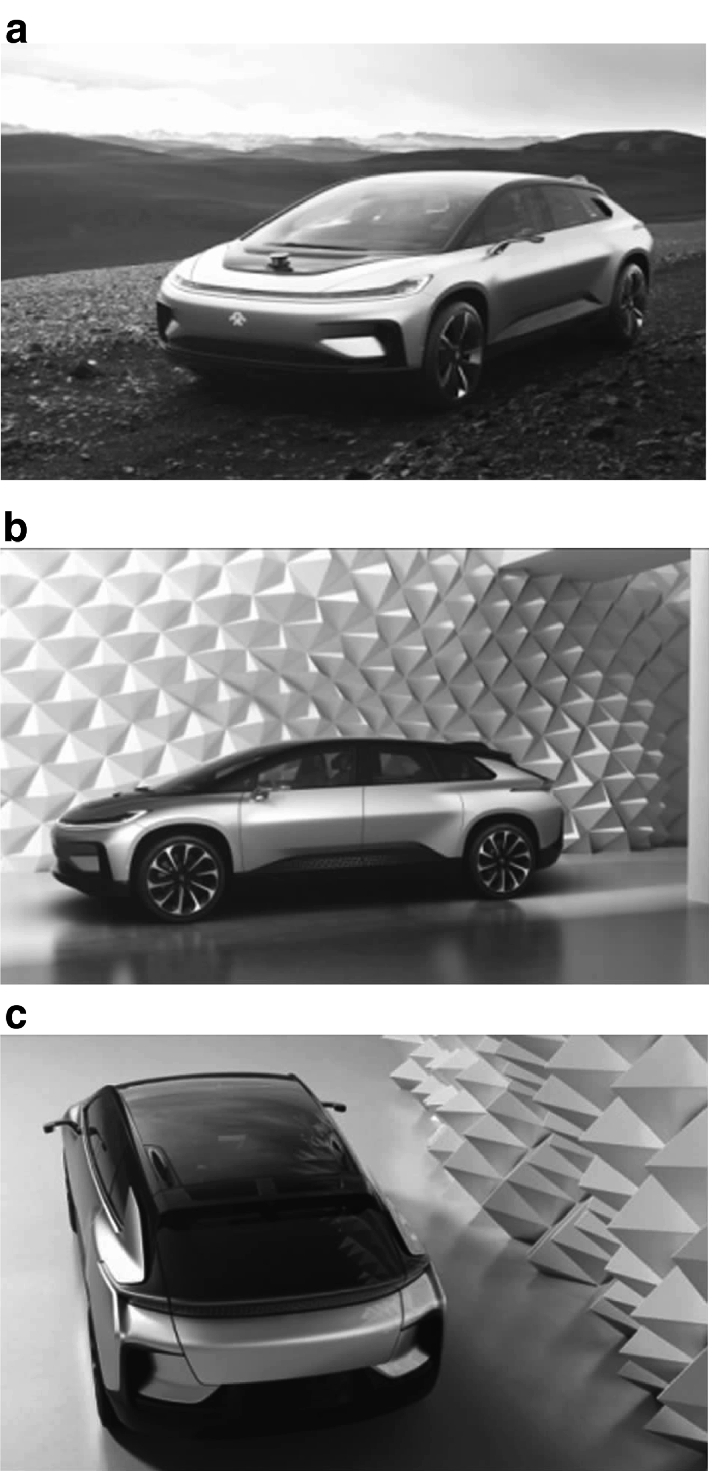

The Battle To Embrace The Trend Springerlink

The Battle To Embrace The Trend Springerlink

2021 Buick Grand National Price New Model And Performance

2021 Buick Grand National Price New Model And Performance

Tesla Gm Lose Bid To Raise Ceiling For Federal Ev Tax Credit

Tesla Gm Lose Bid To Raise Ceiling For Federal Ev Tax Credit

Revologys 1968 Ford Mustang Replica Gets A Ferrari Leather Interior 1968 Mustang Gt Mustang Gt 1968 Mustang

Revologys 1968 Ford Mustang Replica Gets A Ferrari Leather Interior 1968 Mustang Gt Mustang Gt 1968 Mustang

Electric Company Cars Will Be Exempt From Tax In 2020 21

Electric Company Cars Will Be Exempt From Tax In 2020 21

German Carmakers Prepare For E Mobility Future Der Spiegel

German Carmakers Prepare For E Mobility Future Der Spiegel

German Help For Auto Industry Too Weak And Will Require Top Up Report

German Help For Auto Industry Too Weak And Will Require Top Up Report

The Level 3 Audi A8 Will Almost Be The Most Important Car In The World

The Level 3 Audi A8 Will Almost Be The Most Important Car In The World

Germany Boosts Electric Car Sales Incentives But Penalizes Gas Guzzlers

Germany Boosts Electric Car Sales Incentives But Penalizes Gas Guzzlers

German Carmakers Prepare For E Mobility Future Der Spiegel

German Carmakers Prepare For E Mobility Future Der Spiegel

The Battle To Embrace The Trend Springerlink

The Battle To Embrace The Trend Springerlink

German Carmakers Prepare For E Mobility Future Der Spiegel

German Carmakers Prepare For E Mobility Future Der Spiegel

German Help For Auto Industry Too Weak And Will Require Top Up Report

German Help For Auto Industry Too Weak And Will Require Top Up Report

Grants Of Up To 21 450 Euros For An Electric Car Ecovis International

Grants Of Up To 21 450 Euros For An Electric Car Ecovis International

Fleet And Business Tesla Ireland

Fleet And Business Tesla Ireland

1975 Leyland Australia Jaguar Xj6 Xj V12 Aussie Original Magazine Advertisement Jaguar Car Jaguar Xj12 Jaguar Xj220

1975 Leyland Australia Jaguar Xj6 Xj V12 Aussie Original Magazine Advertisement Jaguar Car Jaguar Xj12 Jaguar Xj220

5 Benefits You Should Know About Employee Mileage Reimbursement Rydoo

5 Benefits You Should Know About Employee Mileage Reimbursement Rydoo

2018 Jeep Grand Cherokee Trackhawk Fca Us Llc Srt Hellcat Hellcat Srt

2018 Jeep Grand Cherokee Trackhawk Fca Us Llc Srt Hellcat Hellcat Srt

Komentar

Posting Komentar